The financial world is undergoing a revolution, and at the heart of it lies Artificial Intelligence (AI). Forget robotic tellers and complicated algorithms hidden behind closed doors. Today, AI is transforming customer service, making banking more personal, efficient, and yes, even… enjoyable? The staggering statistic that 63% of banks are now leveraging AI for customer service personalization isn’t just a trend; it’s a seismic shift in how financial institutions are engaging with their customers. But why is this happening? What’s driving this rapid adoption? And more importantly, what does it mean for you and your bank account? Let’s dive deep.

The AI Revolution: From Back Office to Front Line

For years, AI was relegated to the back office, crunching numbers, detecting fraud, and streamlining internal processes. While vital, these applications were invisible to the average customer. Now, AI is stepping into the spotlight, becoming the face of customer service, powered by advancements in natural language processing (NLP), machine learning (ML), and the ever-increasing accessibility of AI-powered tools. This transition is fuelled by a confluence of factors: demanding customers, competitive pressures, and the sheer potential of AI to revolutionize the customer experience.

The Demanding Customer: A Catalyst for Change

Today’s customers are digital natives. They expect instant gratification, personalized experiences, and seamless service across all channels. Think about it:

- 24/7 Availability: Customers want access to their accounts and support whenever they need it, regardless of time zone or business hours. The traditional 9-to-5 banking model is simply outdated.

- Personalized Interactions: Generic responses and one-size-fits-all solutions are no longer acceptable. Customers expect banks to understand their individual needs and preferences.

- Seamless Omnichannel Experience: Customers want to start a transaction on their mobile app, continue it on a web browser, and finalize it with a phone call – all without having to repeat themselves or re-enter information.

- Immediate Problem Resolution: Customers are impatient. They expect quick answers and efficient solutions to their problems. Long wait times and convoluted processes are a surefire way to lose customers.

These evolving expectations are forcing banks to rethink their customer service strategies. Traditional methods, such as call centers and branch visits, are struggling to keep up. AI offers a solution: the ability to provide personalized, efficient, and readily available service at scale.

Competitive Pressures: The Fintech Factor

Banks aren’t just competing with each other anymore. A new breed of agile and tech-savvy Fintech companies is disrupting the financial landscape. These companies, unburdened by legacy systems and bureaucratic processes, are offering innovative and customer-centric solutions that are challenging the status quo. Fintech companies understand the value of exceptional customer experience and use technologies like AI to deliver it.

- Personalized Financial Advice: Fintech apps leverage AI to analyze user data and provide personalized financial advice, such as budgeting tips, investment recommendations, and debt management strategies.

- Streamlined Account Opening: AI-powered chatbots can guide customers through the account opening process, verifying their identity and collecting necessary information quickly and efficiently.

- Automated Fraud Detection: AI algorithms can detect suspicious transactions and flag them for review, protecting customers from fraud and identity theft.

- Proactive Customer Support: AI can proactively identify potential issues, such as unusual spending patterns or upcoming payment deadlines, and reach out to customers with helpful information and support.

To compete with these innovative Fintech companies, traditional banks must embrace AI and transform their customer service offerings. They need to offer the same level of personalization, convenience, and efficiency that customers have come to expect from Fintech apps.

The Power of AI: Transforming Customer Service

AI isn’t just a buzzword; it’s a powerful tool that can fundamentally transform customer service in the banking industry. By leveraging AI, banks can:

- Reduce Costs: AI-powered chatbots can handle a large volume of customer inquiries, freeing up human agents to focus on more complex and high-value interactions. This can significantly reduce operational costs.

- Improve Efficiency: AI can automate repetitive tasks, such as answering frequently asked questions, processing transactions, and verifying customer information. This reduces wait times and improves efficiency.

- Enhance Personalization: AI algorithms can analyze customer data and provide personalized recommendations, advice, and support. This creates a more engaging and satisfying customer experience.

- Increase Customer Satisfaction: By providing personalized, efficient, and readily available service, AI can significantly increase customer satisfaction and loyalty.

- Gain Competitive Advantage: Banks that embrace AI can differentiate themselves from competitors and attract new customers by offering a superior customer experience.

How AI is Personalizing Customer Service in Banking: Concrete Examples

So, how exactly is AI being used to personalize customer service in banking? Here are some concrete examples:

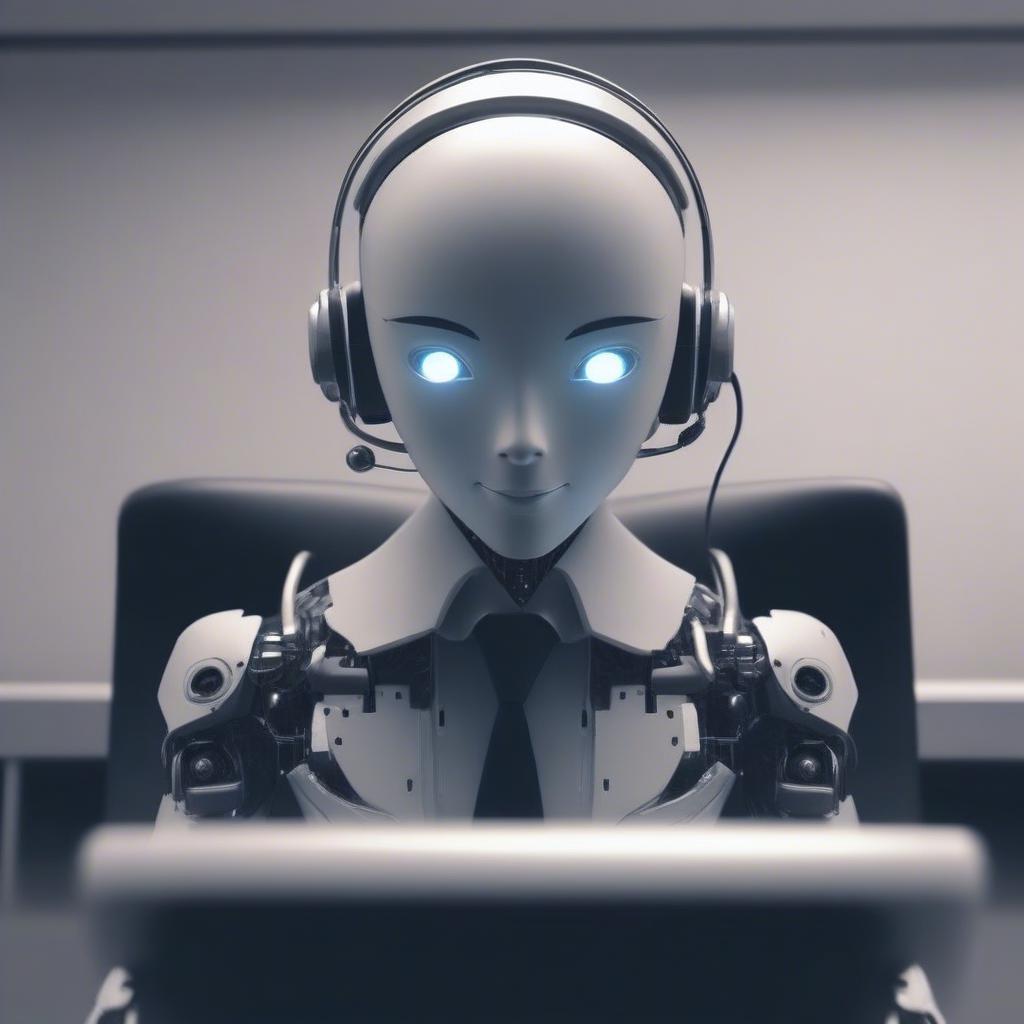

1. AI-Powered Chatbots: The First Line of Defense

Chatbots are the most visible and widely adopted application of AI in customer service. They provide instant support through text or voice, answering frequently asked questions, guiding customers through transactions, and resolving simple issues. Modern AI chatbots are far more sophisticated than their predecessors.

- Natural Language Understanding (NLU): Advanced NLU enables chatbots to understand the nuances of human language, including slang, colloquialisms, and misspellings. This allows them to accurately interpret customer inquiries and provide relevant responses.

- Contextual Awareness: AI chatbots can maintain context throughout a conversation, remembering previous interactions and tailoring their responses accordingly. This creates a more natural and personalized experience.

- Personalized Recommendations: Chatbots can analyze customer data and provide personalized recommendations for products and services, such as credit cards, loans, and investment options.

- Seamless Handoff to Human Agents: When a chatbot is unable to resolve a customer’s issue, it can seamlessly transfer the conversation to a human agent, providing the agent with all the necessary context and information.

Example: A customer wants to check their account balance. They can simply type “What’s my balance?” into the bank’s chatbot. The chatbot will authenticate the customer and immediately display their current balance. If the customer has a more complex question, such as “How do I dispute a fraudulent charge?”, the chatbot can provide step-by-step instructions or connect them to a human agent.

2. Personalized Financial Advice: Guiding Customers to Success

AI can analyze customer data, such as income, spending habits, and financial goals, to provide personalized financial advice. This can help customers make informed decisions about their finances, save money, and achieve their financial goals.

- Budgeting Tools: AI-powered budgeting tools can track spending, identify areas where customers can save money, and create personalized budgets.

- Investment Recommendations: AI algorithms can analyze market trends and individual risk tolerance to provide personalized investment recommendations.

- Debt Management Strategies: AI can help customers develop strategies for paying off debt, such as consolidating loans or creating a repayment plan.

- Proactive Financial Alerts: AI can proactively alert customers to potential financial issues, such as late payment reminders or overdraft warnings.

Example: A customer is saving for a down payment on a house. The bank’s AI-powered platform can analyze their income and expenses and recommend a savings plan that will help them reach their goal. The platform can also provide tips on how to save money, such as reducing discretionary spending or automating savings transfers.

3. Enhanced Fraud Detection: Protecting Customers from Threats

AI is revolutionizing fraud detection in the banking industry. AI algorithms can analyze vast amounts of data in real-time to identify suspicious transactions and patterns, protecting customers from fraud and identity theft.

- Anomaly Detection: AI can identify unusual transactions that deviate from a customer’s typical spending patterns.

- Behavioral Biometrics: AI can analyze a customer’s online behavior, such as their typing speed and mouse movements, to verify their identity.

- Real-Time Fraud Alerts: AI can send real-time fraud alerts to customers when suspicious activity is detected on their accounts.

- Automated Fraud Investigation: AI can automate the fraud investigation process, reducing the time it takes to resolve fraudulent transactions.

Example: A customer’s credit card is used to make a large purchase in a foreign country. The bank’s AI-powered fraud detection system flags the transaction as suspicious and immediately sends a text message to the customer asking them to confirm the purchase. If the customer confirms that the purchase is fraudulent, the bank can immediately block the card and prevent further unauthorized transactions.

4. Streamlined Loan Applications: Making Borrowing Easier

AI can streamline the loan application process, making it faster, easier, and more convenient for customers to apply for loans.

- Automated Document Processing: AI can automatically extract information from loan applications and supporting documents, reducing the need for manual data entry.

- Automated Credit Scoring: AI can analyze a customer’s credit history and financial information to automatically generate a credit score.

- Personalized Loan Offers: AI can provide personalized loan offers based on a customer’s individual needs and financial situation.

- Faster Loan Approvals: AI can automate the loan approval process, reducing the time it takes for customers to receive a loan decision.

Example: A customer wants to apply for a personal loan. They can complete an online loan application and upload the required documents. The bank’s AI-powered system will automatically extract the information from the application and documents, generate a credit score, and provide a personalized loan offer. The customer can then accept the offer and receive the loan funds within a few days.

5. Proactive Customer Service: Anticipating Needs and Solving Problems Before They Arise

AI enables banks to provide proactive customer service, anticipating customer needs and solving problems before they even arise.

- Personalized Alerts and Notifications: AI can send personalized alerts and notifications to customers, such as payment reminders, low balance warnings, and upcoming payment deadlines.

- Proactive Problem Resolution: AI can proactively identify potential issues, such as unusual spending patterns or upcoming payment deadlines, and reach out to customers with helpful information and support.

- Personalized Product Recommendations: AI can analyze customer data and recommend products and services that are relevant to their individual needs and interests.

- Personalized Onboarding Experiences: AI can personalize the onboarding experience for new customers, providing them with tailored information and support.

Example: A customer frequently overdraws their account. The bank’s AI-powered system detects this pattern and sends the customer a personalized notification offering tips on how to avoid overdraft fees. The notification may also include information about overdraft protection options.

The Future of AI in Banking: What to Expect

The AI revolution in banking is just beginning. As AI technology continues to evolve, we can expect to see even more innovative and impactful applications in the years to come.

Enhanced Personalization: A Deeper Understanding of the Customer

AI will become even better at understanding individual customer needs and preferences, leading to hyper-personalized experiences. This will involve:

- Sentiment Analysis: AI will be able to analyze customer sentiment in real-time, allowing banks to tailor their responses and interactions accordingly.

- Predictive Analytics: AI will be able to predict future customer needs and behaviors, enabling banks to proactively offer relevant products and services.

- Real-Time Personalization: AI will be able to personalize the customer experience in real-time, based on their current context and interactions.

Increased Automation: Streamlining Processes and Reducing Costs

AI will automate even more banking processes, freeing up human agents to focus on more complex and strategic tasks. This will involve:

- Robotic Process Automation (RPA): RPA will be used to automate repetitive tasks, such as data entry, account reconciliation, and regulatory reporting.

- Intelligent Automation: Intelligent automation will combine AI with RPA to automate more complex and decision-making tasks.

- Self-Service Banking: AI-powered self-service banking platforms will allow customers to perform a wide range of tasks without human assistance.

Improved Security: Protecting Customers from Emerging Threats

AI will play an increasingly important role in protecting customers from fraud and cybercrime. This will involve:

- Advanced Threat Detection: AI will be able to detect and prevent sophisticated cyberattacks in real-time.

- Identity Verification: AI will be used to verify customer identities and prevent identity theft.

- Fraud Prevention: AI will be able to predict and prevent fraudulent transactions before they occur.

The Rise of AI-Powered Virtual Assistants: Your Personal Banking Concierge

We can expect to see the emergence of sophisticated AI-powered virtual assistants that act as personal banking concierges, managing finances, providing advice, and executing transactions on behalf of customers.

- Voice-Enabled Banking: Customers will be able to interact with their bank through voice commands, making banking more convenient and accessible.

- Personalized Financial Planning: Virtual assistants will be able to provide personalized financial planning advice based on a customer’s individual goals and circumstances.

- Automated Bill Payment: Virtual assistants will be able to automate bill payments, ensuring that bills are paid on time and avoiding late fees.

Navigating the AI Landscape: Choosing the Right Solutions

With so many AI solutions available, choosing the right ones can be overwhelming. Banks need to carefully evaluate their needs and objectives before investing in AI technology. Here are some key considerations:

- Define Your Goals: What are you hoping to achieve with AI? Do you want to improve customer satisfaction, reduce costs, or increase revenue? Clearly defining your goals will help you choose the right solutions.

- Assess Your Data: AI requires data to function effectively. Do you have enough data to train AI algorithms? Is your data clean and accurate?

- Consider Your Infrastructure: Do you have the infrastructure in place to support AI? Do you need to invest in new hardware or software?

- Choose the Right Vendor: There are many AI vendors to choose from. Do your research and select a vendor that has a proven track record and understands your specific needs.

- Start Small and Iterate: Don’t try to implement AI across your entire organization at once. Start with a small pilot project and iterate based on the results.

AI Business Consultancy: Your Partner in the AI Revolution

Navigating the complexities of AI implementation can be challenging. That’s where AI Business Consultancy (https://ai-business-consultancy.com/) comes in. We are a team of experienced AI consultants who help businesses leverage the power of AI to achieve their goals.

We offer a range of services, including:

- AI Strategy Development: We help you develop a comprehensive AI strategy that aligns with your business objectives.

- AI Solution Selection: We help you choose the right AI solutions for your specific needs.

- AI Implementation: We help you implement AI solutions effectively and efficiently.

- AI Training and Education: We provide training and education to your employees on AI technologies.

Our expertise can guide you through the process of identifying the most suitable AI solutions, strategizing their implementation, and ensuring their effective integration into your existing banking ecosystem. Let us help you unlock the full potential of AI and transform your customer service offerings.

Addressing Concerns: The Human Touch Matters

While AI offers numerous benefits, it’s crucial to acknowledge and address potential concerns:

- Data Privacy and Security: Customers are increasingly concerned about the privacy and security of their data. Banks must ensure that AI systems are secure and that customer data is protected. Compliance with regulations like GDPR is paramount.

- Job Displacement: There are concerns that AI will lead to job displacement in the banking industry. While AI will automate some tasks, it will also create new opportunities. Banks need to invest in training and education to help employees adapt to the changing job market.

- Lack of Human Connection: Some customers may prefer to interact with a human agent rather than a chatbot. Banks must ensure that human agents are available to handle complex issues and provide personalized support. The key is to find the right balance between AI-powered automation and the human touch.

- Algorithmic Bias: AI algorithms can be biased if they are trained on biased data. Banks need to ensure that their AI algorithms are fair and unbiased. Regular audits and transparency are crucial.

Ultimately, the success of AI in banking depends on striking a balance between technology and the human element. AI should be used to augment human capabilities, not replace them entirely. By focusing on improving the customer experience, protecting customer data, and ensuring fairness and transparency, banks can harness the power of AI to create a more efficient, personalized, and secure banking environment for everyone.

Conclusion: The Future is Personalized

The data is clear: AI is transforming customer service in banking. The 63% adoption rate is a testament to the power of AI to personalize experiences, improve efficiency, and enhance security. By embracing AI, banks can meet the evolving expectations of their customers, compete effectively in the Fintech landscape, and unlock new opportunities for growth. But remember, technology is a tool, not a replacement for human connection. The future of banking is personalized, yes, but it’s also human-centric, ethical, and secure. It’s about leveraging AI to build stronger relationships with customers, empower them to achieve their financial goals, and create a more inclusive and equitable financial system for all. It’s about building trust in a digital age.

Leave a Reply